How to break into Venture Capital in the Middle East

(if you’re not from the region)

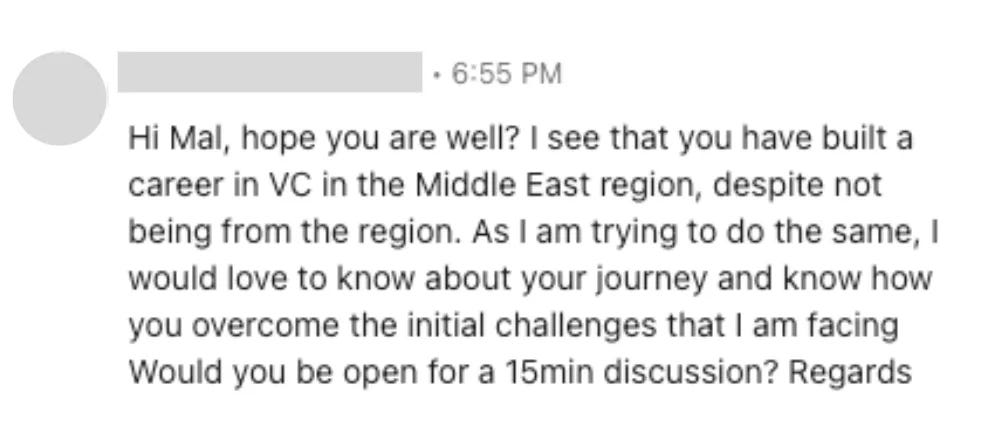

In the last three years spent in the Middle East, between UAE and Qatar, probably the most frequently asked job-related question that I get from friends, common friends, and strangers on LinkedIn is, “Hey, I see that you moved to the Middle East and managed to get a job in VC despite not being from the region. How do I do the same?”

No surprise. This place has it all: an excellent quality of life, career opportunities, exciting projects, good weather for most of the year, and a strong sense of safety. But what truly sets the Middle East apart is its rapidly growing venture capital industry.

My third Middle East anniversary was a great motivator to write down my thoughts about what I saw working well for people who want to start a new chapter in a Middle Eastern VC (and also, I want to have a link I can share with everyone who asks in the future ✨)

My story

My move to the Middle East was semi-spontaneous. My boyfriend had just gotten a good job offer and was planning a move to Abu Dhabi, so I started looking. It was May 2021. I was still living in Warsaw, working with an impact VC in Poland, and three months later, I found myself working in Abu Dhabi for the most active seed-stage VC in the region.

How did it happen? It was definitely good timing — in the middle of the COVID pandemic, only a few people were considering relocating to other parts of the world, so there was an evident talent shortage in the region that heavily relies on qualified expats. At the same time, Flat6labs re-opened their UAE office and sought people to join their team. It was a match made in heaven (both in terms of timing and the fit itself).

That was lucky. Yet, if I were to move to GCC now, I would do precisely the same thing.

#1 Check what new funds are opening up

This was my luck, but here’s the good news: more and more VC funds are in the region.

Investor numbers in the Middle East and North Africa’s venture capital ecosystem increased 33 percent annually in the first half of 2024. According to a report from venture data platform MAGNiTT, rising sentiment spurred a 130% increase in the number of funds launched in the MENA region during the last year (Source).

On top of that:

In January 2024, Oman’s sovereign wealth fund, Oman Investment Authority, launched a $5.2 billion fund to encourage investments in the private sector and small and medium-sized enterprises. (Source)

In February 2024, the Qatar Investment Authority announced a new Qatar Venture Capital Fund of Funds exceeding US$ 1 billion. (Source)

Jada Fund of Funds has an estimated size of approximately $1.07 billion (KSA) (Source)

PIF’s Sanabil commits approximately $3 billion in capital per annum in private investments that include venture, growth capital and small buyout (KSA) (Source)

Mubadala, DFDF, ADIA, and ADQ continue their direct and FOF investments (UAE)

The future for this region is bright! This means that international and new local funds will be looking for people on the ground. 👀

#2 Keep yourself up to date with the local news

Stay on top of the local news to know what’s going on and which funds announce their MENA expansion, next funds, or launches.

I recommend to follow:

Zawaya: https://www.zawya.com/en/mena

MENA bytes: https://www.menabytes.com/

Magnitt: https://magnitt.com/

#3 Build relationships

In the Middle East, one of the critical values of the business world is TRUST. Establishing trust and building relationships is crucial to a successful move. Here are some ideas:

Visit the region for one of the industry events: GITEX (Expand North Star) in Dubai, WebSummit in Qatar, and LEAP in Riyadh to connect with the local ecosystem and express your interest in the region; everybody appreciates it.

Show everybody you mean it: develop a reputation for bringing high-quality deal flow. Share information about companies from outside the MENA region that are looking to expand into the Middle East and are fundraising.

#4 Bring experience

Middle East is a market that attracts experienced professionals from all over the world. That being said, the bar is high, and the majority of people who move to the region have a solid couple of years of experience from other parts of the world. To differentiate yourself in this competitive landscape, gain relevant experience elsewhere. It could be, for example, previous experience in VC, including sourcing deals, performing due diligence, portfolio management, and understanding the entire investment lifecycle or deep knowledge in specific sectors (e.g., fintech, health tech, e-commerce) that are of high interest in the Middle East VC landscape.

Final thoughts

Breaking into VC in the Middle East is more straightforward than it seems if you know where to look and what to do. The key is to be proactive — I was surprised when General Partners of the top funds in the United Arab Emirates agreed to casually chat with me while I was still in Poland and how transparent they were in their feedback. All I did was message them on LinkedIn. I’m forever grateful for these calls!

By approaching this transition with diligence, adaptability, and a genuine interest in contributing to the local market, you can achieve your career goals and become a part of the Middle East’s remarkable growth story.

By the way, life here is incredible. This is our recent camping spot in Qatar.

This post was previously published on Medium.com in July 2024