The Path to Midas

What Life & Career choices increase the odds of becoming one of the world's best Venture Capitalists?

Last year, I came across a fantastic piece of research published by Endeavor showcasing the pathways of 200 unicorn founders. The patterns were really hard to ignore: most had lived or worked abroad, spent time at a startup or scale-up, built something before, and had a science or engineering background.

But as a Venture Capitalist, I couldn't stop thinking: do top VCs follow similar paths? To find out, I analysed the backgrounds of 120 investors from the 2024 and 2025 Forbes Midas Lists. Only 20 new names appeared in 2025, so I merged the two years into one dataset.

I wanted to know what the patterns are in their career paths. What can we learn from the life and career choices of people who consistently back billion-dollar companies?

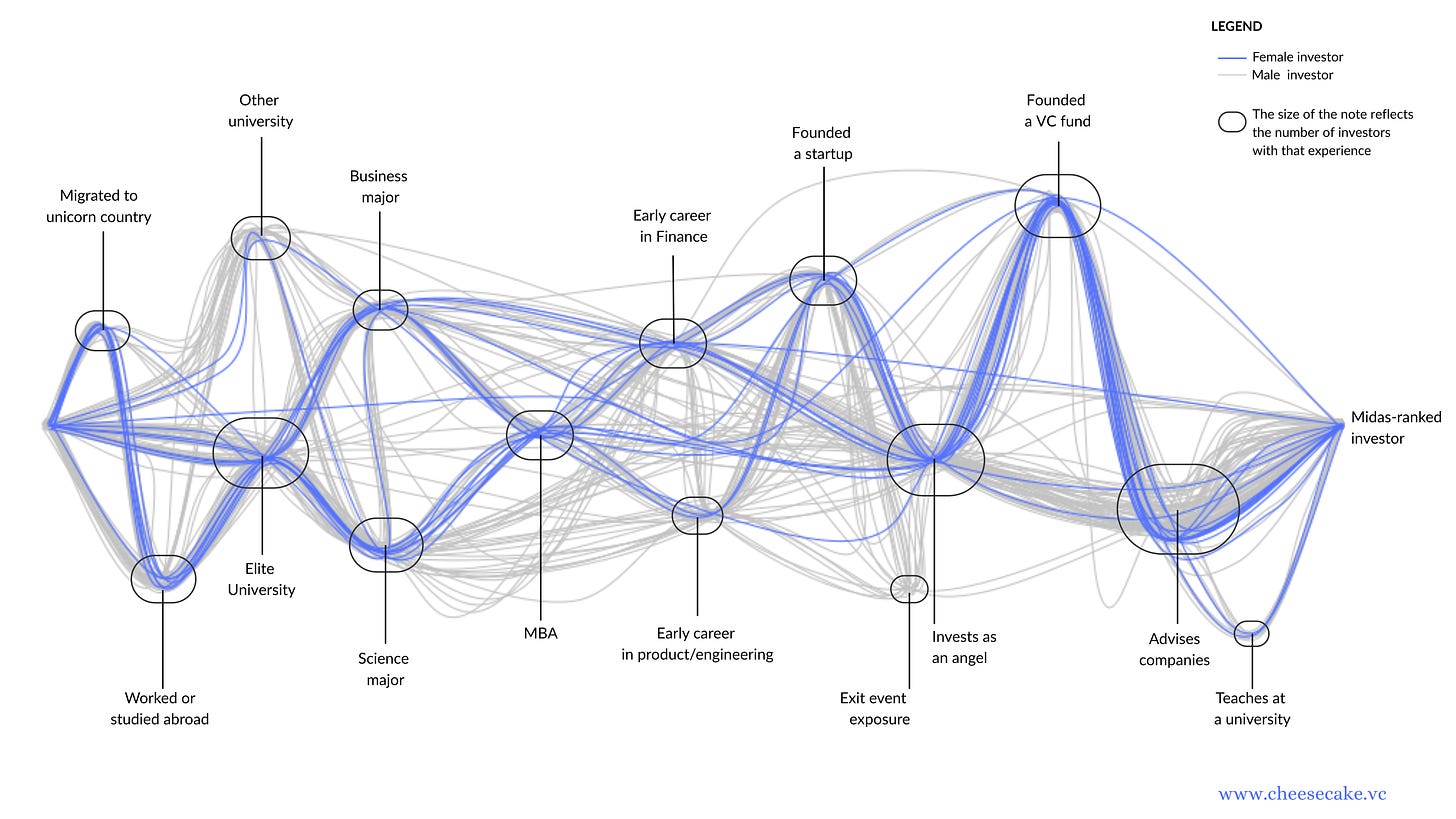

VC Pathways Chart

It all starts with an international background and an elite university

Just like unicorn founders, many top VCs have global roots. Nearly half either studied abroad, worked in a different country, or migrated to a major startup hub. It's hard to measure exactly what impact this had, but it likely gave them a wider lens on the world and helped them build diverse, global networks early in their careers.

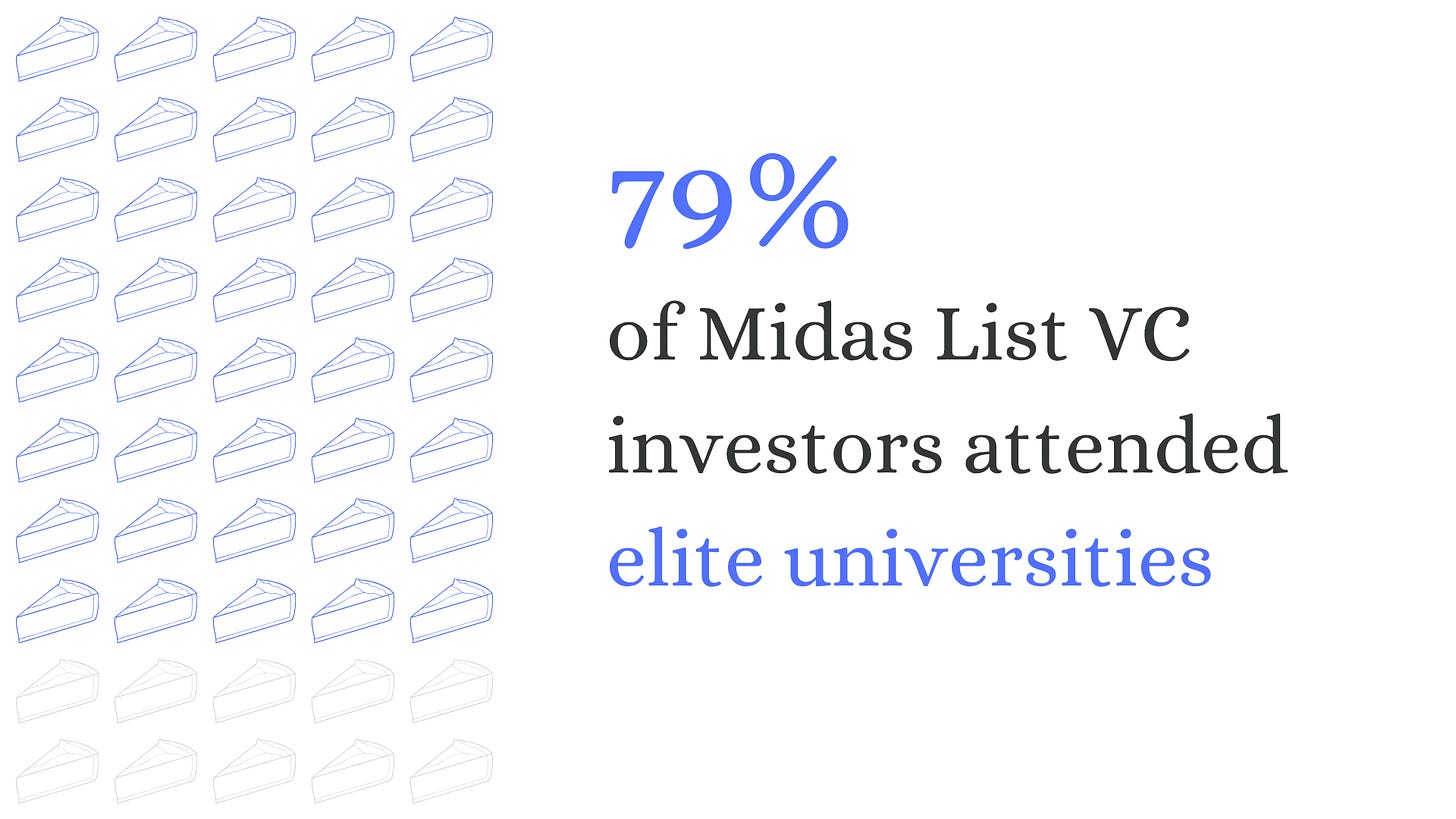

Speaking of network, the best of them are being built at the top global schools: 79% of Midas List VC investors attended elite universities. It doesn't come as a surprise. As Professor Ilya Strebulaev published recently, three out of every five senior VC investors got educated in a top US school and almost half studied at an Ivy or Ivy+

Across the board, elite universities emerge as the strongest early-career lever by providing access to networks that become a deal flow and co-investor relationships for decades.

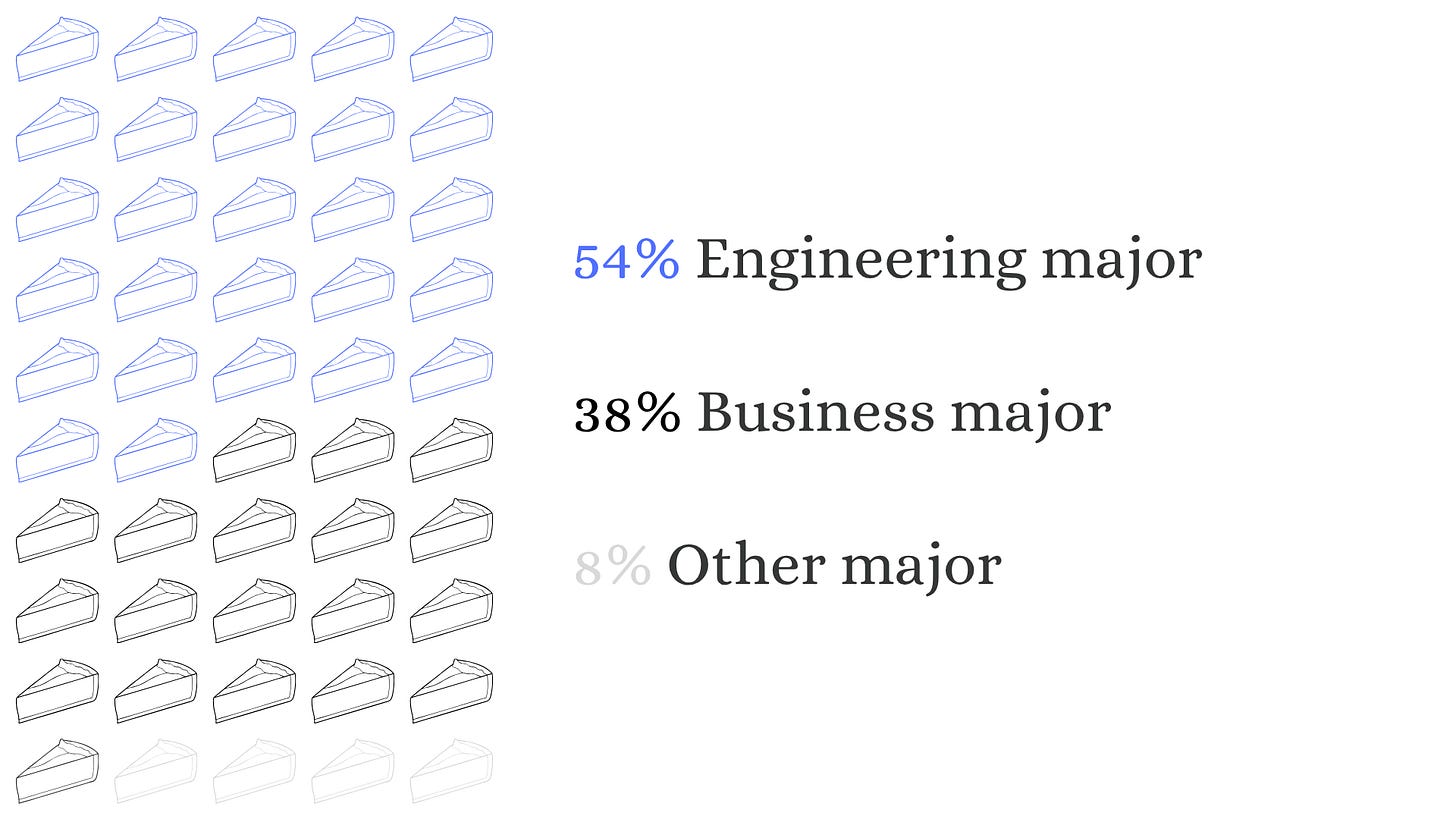

54% of successful VCs have science or engineering backgrounds, compared to just 38% with business majors. This technical skillset becomes even more pronounced when looking at early career paths: 36% of Midas VC investors started in product or engineering roles.

It appears that VCs who can evaluate technical feasibility, understand product roadmaps, and speak the language of engineering teams have a significant advantage.

Best VC investors founded “SOMETHING”

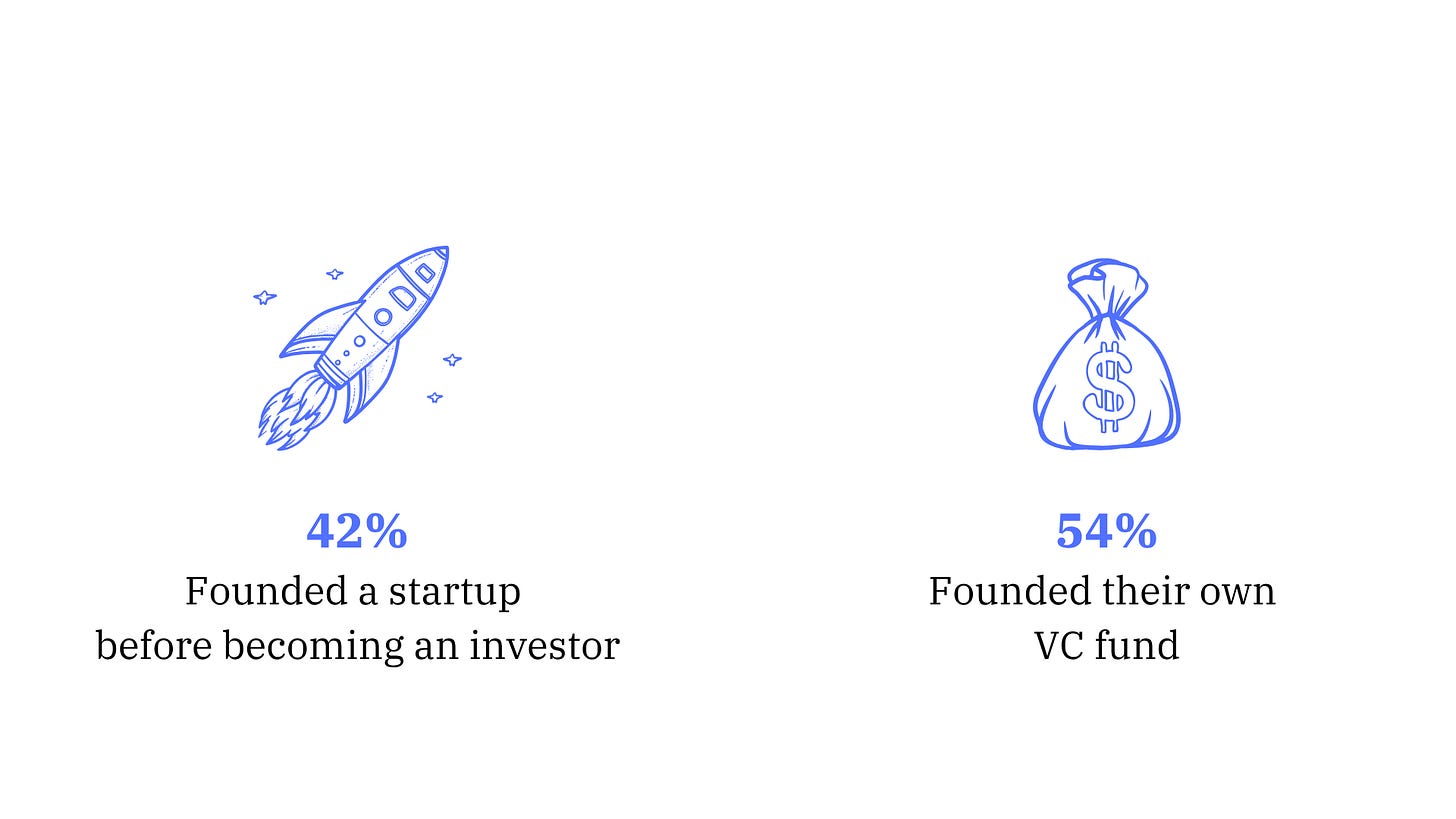

Perhaps the most telling statistic in the entire dataset: 42% of Midas List VCs founded their own startup(s) before moving into investing. And it does make sense: founders-turned-investors bring a unique perspective. They've been in the trenches, they understand the emotional rollercoaster, the operational challenges, and the nuances of building something from scratch. This experience allows them to empathise deeply with founders and offer practical, often battle-tested advice. VCs of that profile might also have a higher likelihood of access to great deals, and founders might find them incredibly valuable for opening doors, making introductions, and helping startups gain traction.

54% of top VCs founded their own venture capital funds rather than climbing the ladder at established firms. The traditional model of spending 15 years working one's way up from analyst to partner is not very common among top performers.

Best VCs live and breathe their work

90% of the world's best VC investors invest their capital as angel investors, and 94% actively advise companies. This level of engagement extends far beyond traditional investing, suggesting that the most successful VCs view venture capital as a lifestyle rather than just a job.

Jack Altman once noted that being in the right networks and seeing the best deals is more critical than being an exceptional picker. By immersing themselves in the ecosystem, through angel investing and advising, VCs increase their surface area for opportunities and build trust with founders.

Surprise!

The best VCs aren't necessarily building big personal media brands. Very few run podcasts or focus on constant self-promotion, contrary to the image often portrayed online.

Another unexpected finding was that none of these top investors were college dropouts, a path sometimes glorified in Silicon Valley. Instead, most followed more traditional educational routes before carving out their own unique paths in the venture world.

Only 45% have MBAs, suggesting advanced business education is just as good as operational experience.

Take it with a pinch of salt

The Forbes Midas List, widely seen as the definitive ranking of top venture capitalists, deserves a more critical look. Its ranking method focuses on big exits and high valuations within a five-year window. This naturally favours late-stage investors and short-term wins over early-stage VCs who often take bigger risks and earn the highest returns. The methodology struggles to separate individual versus firm credit and doesn't fully capture geographic diversity beyond Silicon Valley.

In short, while the patterns are interesting, they don't tell the whole story, especially when it comes to early-stage investors, diverse managers, or exceptional investors outside of the leading VC hubs.

"The future is built elsewhere"

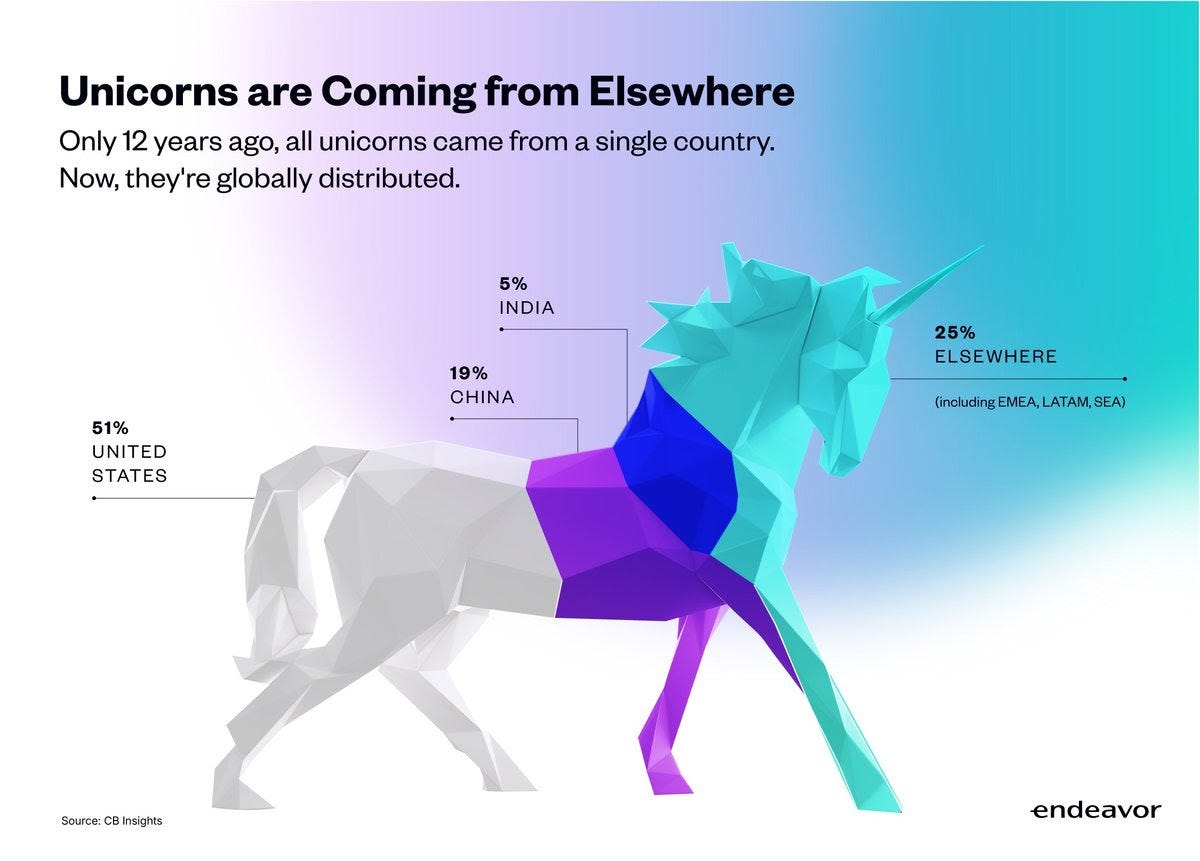

The patterns revealed in this analysis may represent the last generation of a distinctly American venture capital archetype. As venture capital continues its rapid globalisation, with US investments dropping from 95% of global VC twenty years ago to just 40% today, the elite university networks and Silicon Valley operational experience that define today's Midas List may become less relevant predictors of success.

"In 2013, Aileen Lee coined the term "unicorn" to describe the rare breed of private billion-dollar startups. At the time, there were 39 of them, all US-based. Fast forward to today, and there are over 1,400 unicorns globally. Half of them are outside the US. If this follows a similar path as capital deployment did, likely, we're only a year or two away from having a majority of non-US unicorns around the world."

Endeavor monthly roundup, July 2025

The next generation of top VCs will likely emerge from different educational systems and build companies in markets such as MENA, CEE, LatAm or SEA. As unicorns increasingly originate from economies beyond the traditional Big Six (the US, China, India, Germany, the UK, and Israel), the venture capitalists backing them will need different skill sets, networks, and cultural fluency than today's Midas List winners.

The credentialed operator-founder archetype documented here may soon give way to a more globally diverse set of paths to venture capital excellence: one that reflects the reality that the future of this industry is increasingly built outside of the major hubs.

DATA EXPLAINER

Migrated to a Unicorn Country: The investor—or their parents—moved to the US, India, or China at some point. These are the countries that have produced the most unicorns globally.

Studied or Worked Abroad: The investor completed a university degree or held a full-time job in a different country from where they grew up.

Elite University: The investor earned a bachelor's degree from a university ranked in the top 100 of the 2025 QS World University Rankings.

Other University: The investor earned a bachelor's degree from a university outside the top 100 of the 2025 QS World University Rankings.

Science Major: The investor pursued a university degree in a scientific or technical field (e.g. engineering, physics, computer science).

Business Major: The investor studied business, economics, or a related field at university.

MBA: The investor completed a Master of Business Administration degree.

Early Career in Finance: The investor started their career in investment banking, private equity, hedge funds, or a similar finance-related field.

Early Career in Product/Engineering: The investor began their career in a technical or product-related role at a startup or tech company.

Founded a Startup: The investor previously started their own company, regardless of whether it was successful or not.

Exit Event Exposure: The investor either:

– founded a company that was acquired or IPO’d,

– worked at a company that went through a major exit,

Invests as an Angel: The investor makes personal investments in startups, outside of their institutional role.

Founded a VC Fund: The investor is a founding partner or co-founder of a venture capital fund.

Advises Companies: The investor actively advises startups (formally or informally), often taking advisory roles.

Teaches at a University: The investor holds or has held a teaching or guest lecturer position at a university.