Growth as a VC value-add

Growth as a post-investment platform focus is unpopular but potentially revolutionary.

Across the globe, most VC funds share a common goal: helping their portfolio companies reach their full potential. The range of initiatives funds implement to drive portfolio success—and ultimately enhance their own performance—falls under what’s known as the "VC platform." In the last twenty years, Platform roles in VC have grown significantly faster than the industry itself.

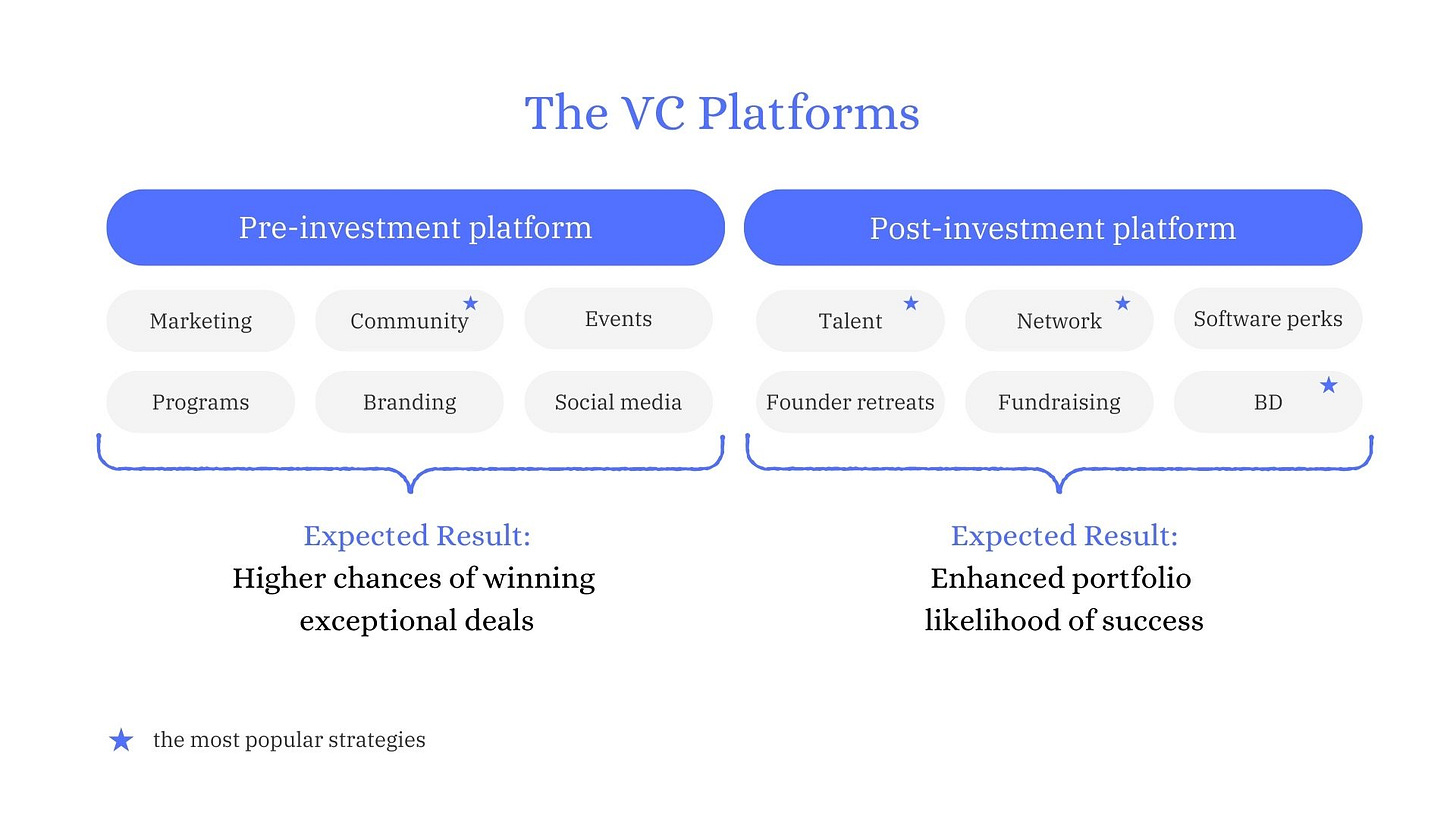

VC Platforms now cover a wide range of roles focused on delivering strategic value both pre- and post-investment.1 In this article, I'll dive into the world of post-investment platforms at the early stage.

I see the post-investment platform as a portfolio success engine. For VCs, it’s a way to stand out in competitive deals by offering startups more than capital and to differentiate the fund when pitching to LPs.

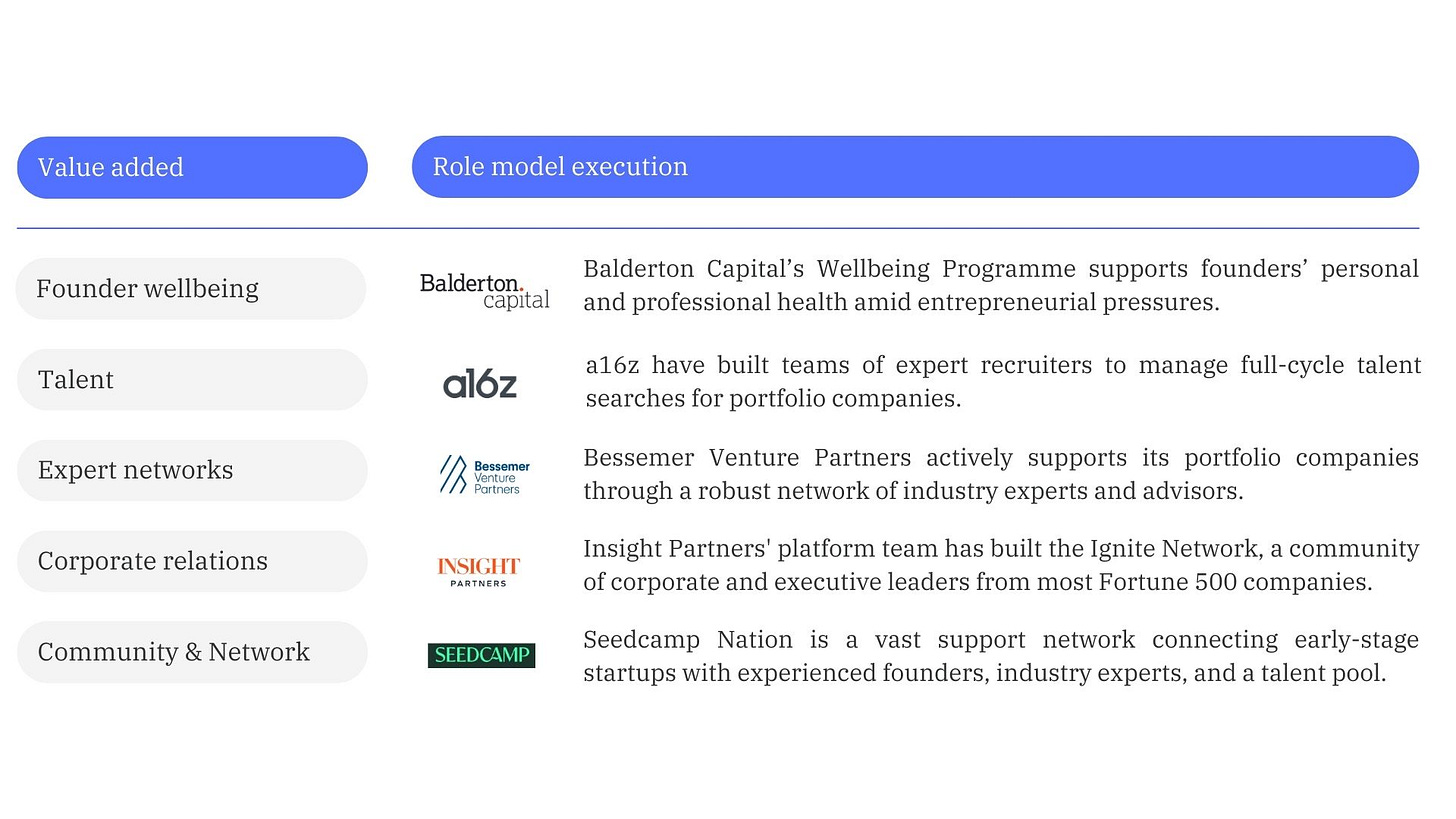

Talent, Business Development, and Community/Network are the most popular ways VCs engage with portfolio companies after the investment (according to a study of 850 VC firms). Other fairly popular post-investment platform strategies are listed below.

While all these initiatives aim to help portfolio companies scale, only a few VCs take a step back to focus on growth itself, especially with a structured, framework-driven approach.

Startup = Growth

Growth is a critical factor that can make or break a startup. It validates the scalability of the business model, attracts investors, and often leads to long-term success.

Startups are designed to grow quickly. Their success depends on capturing market share, outpacing competitors, and achieving scale before resources run out. Unlike traditional businesses, which can grow steadily over time, startups often operate in fast-moving, high-risk environments where rapid growth is critical to survival. Citing the timeless Paul Graham's post from 2012, Startup = growth: "The only essential thing is growth. Everything else we associate with startups follows from growth."

Focusing on the right goals at the right time

The common belief in the startup ecosystem is that founders should follow a structured path through each funding stage, with specific goals at each step. At the pre-seed stage, the priority is to validate the problem and solution and test the MVP with early users to confirm demand. At the seed stage, the focus shifts to achieving product-market fit. Here, founders refine their product based on user feedback, engage a core group of customers, and test growth channels. By Series A, the focus is on scaling.

Growth is a process

But, ironically, growth isn't always about growing. Adopting the growth mindset very early can be a crucial part of the journey to achieving product-market fit. Developing a growth hypothesis and testing it early on helps founders identify the right channels and strategies that align with their product’s value. For example, if targeting product-led growth, the product should be designed to drive acquisition and retention from the start.

Early growth efforts can help to establish key growth engines. For instance, Duolingo's initial growth was significantly driven by word of mouth, which accounted for about 90% of its DAU growth. By focusing on growth from the start, Duolingo created a self-sustaining loop where user acquisition feeds into product improvement, leading to more users and so on. Another great example is Airbnb: from the beginning, the team worked hard to enhance the experience for hosts and guests. They knew that building trust was essential, so they made key decisions to support that—like investing in professional photography for listings, which helped boost both trust and the number of bookings. During the early days, Airbnb also launched a host referral program, turning word-of-mouth into a powerful growth engine. Prioritising growth from day one enabled Duolingo and Airbnb to lay a strong foundation for long-term success, allowing founders to quickly grasp market dynamics, customer needs, and product effectiveness—ultimately accelerating their ability to iterate and improve.

Duolingo’s and Airbnb's stories prove that growth needs a solid foundation; skipping this foundation phase can lead to failure. For instance, Clubhouse, founded in early 2020, saw explosive 10x growth during the pandemic in late 2020/21, but the hype faded quickly. Even CEO Paul Davison acknowledged, "Extreme hypergrowth is not good for a company. The ideal is to grow at a steady pace."

Could Clubhouse's investors have prevented that? Maybe. Some VCs build teams to ensure sustainable growth, aiming to avoid clubhouse-like stories.

Leading examples of growth-centric platforms

Harry Stebbings' 20VC fund, which recently closed a new $400M fund (and invested in 6 seed unicorns in just 5 years! 🤯), stands out by offering more than capital. Stebbings has structured the firm with specialised sub-funds, including 20Growth, 20Sales, and 20Product.

Not surprisingly, 20Growth started as a post-investment platform. 20VC initially assembled leading growth and product experts to assist its founders, which grew into 20Growth, a dedicated sub-fund with nine industry veterans from companies like Shopify, Dropbox, Pinterest, and DoorDash. The US$5M fund provides hands-on and practical guidance in critical areas like user acquisition, retention, marketing, and revenue growth. Portfolio companies "get nine of the best growth leaders with one check."

Stage 2 Capital is another fund that takes growth support to the next level. The fund invests in early-stage B2B software companies and works closely with leadership teams to establish and drive sustainable revenue growth. Mark Roberge, the Managing Director of Stage 2 Capital developed a fantastic guide, "The Science of Scaling," which showcases the proven approach to building a revenue engine—from product-market fit through go-to-market fit all the way to growth and the moat phase. Additionally, the fund's network of 250 experienced GTM executives provides portfolio companies with direct access to seasoned professionals.

Growth is also our main focus at Seedstars International Ventures, making Seedstars the first global early-stage fund in emerging markets to build a platform centred on growth. The execution follows three elements: Our Entrepreneur in Residence hosts regular growth-related webinars, open to all portfolio team members and available for repeated participation, ensuring continuous learning for new hires. To turn knowledge into action, each portfolio company is paired with a Growth Partner—an industry expert, often with unicorn experience—who guides them in applying best growth practices. Finally, we foster collaboration through peer-learning sessions, where companies share insights and strategies across the portfolio.

At its core, the growth focus we propose as a fund involves running rapid experiments across different marketing channels and product development initiatives to discover the most efficient ways to drive business growth.

Growth Resources Beyond VC Support

Undoubtedly, a holistic approach to growth is a must for every ambitious startup. Luckily, there are great resources that founders can use in case they can't rely on their investors.

The first is Reforge, a platform offering in-depth growth programs led by top industry experts. Their Growth Series is particularly well-known for providing actionable frameworks and strategies used by high-growth companies such as Dropbox and HubSpot.

Lenny's Newsletter: run by Lenny Rachitsky, a former product manager at Airbnb. This newsletter offers deep insights into growth tactics, product management, and scaling companies. I couldn't recommend it more!

Given that the founders know what they’re looking for, it’s worth checking out Growth Mentor. This platform connects founders with experienced growth professionals for one-on-one advice. It's ideal for those seeking hands-on help.

The Power of Diverse VC Support

It is still rare in venture capital to make growth a core part of platform strategy. While it’s a perfect fit for some funds, others may create more impact with different approaches. At the end of the day, this diversity is beneficial, as it allows founders to choose investors based on the specific value they bring to the table, ideally giving each investor a unique role.

Ultimately, the market rewards growth above all else. More VCs, especially those in emerging markets, need to step up with hands-on, practical support, whether for hiring, product development, networking, or growth.

Thank you to Konstantin Hapkemeyer, Charlie Graham-Brown, Cyrine Ben Fadhel and Tiziana Bombassei for providing feedback on the early drafts of this post.

If you want to explore the world of VC platforms more deeply, I recommend reading "From Find to Exit: The Strategic Role of Platform in Venture Capital" by Cory Bolotsky and "VC Platform Overview & Strategy" by Olivia O'Sullivan.